الدخل السلبي للعملات المشفرة يعد موضوعًا شائعًا ومهمًا في عالم الاستثمار الرقمي اليوم. هذا النوع من الدخل يوفر فرصة للمستثمرين لتحقيق أرباح دون الحاجة لبذل جهد نشط يوميًا. بفضل التطورات التكنولوجية ونمو سوق العملات المشفرة، أصبحت طرق تحقيق الدخل السلبي أكثر تنوعًا وإتاحة للمستثمرين حول العالم. في هذا المقال، سنستعرض بعض الطرق الأكثر فعالية لتوليد دخل سلبي من خلال العملات المشفرة.

طرق لكسب الدخل السلبي للعملات المشفرة

1. التعدين السحابي

التعدين السحابي يعتبر واحدًا من الطرق الشائعة لتوليد الدخل السلبي في عالم العملات المشفرة. يتيح هذا النموذج للمستثمرين المشاركة في تعدين العملات دون الحاجة إلى شراء أو صيانة الأجهزة المعقدة المستخدمة في التعدين التقليدي. من خلال الاستثمار في خدمات التعدين السحابي، يمكن للمستخدمين شراء قوة تجهيز والاستفادة من الأرباح المتولدة.

2. الإقراض والتوقيع المشفر

الإقراض المشفر يسمح للمستثمرين بتوليد دخل سلبي عن طريق إقراض عملاتهم المشفرة للمستخدمين الآخرين مقابل فائدة. منصات مثل Aave وCompound توفر بيئات آمنة لهذا النوع من الاستثمار. بالإضافة إلى ذلك، التوقيع المشفر يتيح فرصًا للمستثمرين لكسب المال ببساطة عن طريق التوقيع على معاملات باستخدام مفاتيحهم الخاصة.

3. تكديس العملات (Staking)

تكديس العملات أو “Staking” هي طريقة تتيح للمستخدمين تأمين مبالغ من العملات في محفظة خاصة لدعم عمليات الشبكة والتحقق من المعاملات. كمكافأة، يتلقى المستثمرون جزءًا من العملات الجديدة المتولدة. هذا يشبه إلى حد ما كسب الفائدة على الأموال المودعة في حساب بنكي.

4. استخدام روبوتات التداول

التداول الآلي عن طريق استخدام روبوتات مثل Coinrule أو Cropty يمكن أن يوفر دخلًا سلبيًا عن طريق تنفيذ استراتيجيات تداول محددة مسبقًا في السوق. هذه الروبوتات تحلل السوق وتنفذ الأوامر وفقًا للإعدادات التي يحددها المستخدم، مما يسمح بتحقيق الأرباح حتى عندما لا يكون المستثمر نشطًا بشكل مباشر.

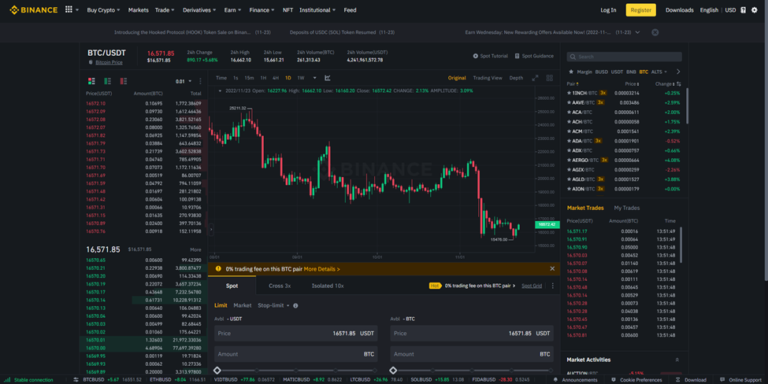

5. التداول بالعملات المشفرة

على الرغم من أنه ليس دخلًا سلبيًا بالمعنى التقليدي، التداول بالعملات المشفرة يمكن أن يكون مصدرًا مهمًا للربح. من خلال تطبيق استراتيجيات تداول مدروسة ومراقبة السوق بانتظام، يمكن للمستثمرين تحقيق أرباح كبيرة من تقلبات أسعار هذه الأصول.

هذه الطرق تظهر التنوع والإمكانيات الكبيرة لتحقيق الدخل السلبي في عالم العملات المشفرة، وتوفر للمستثمرين فرصًا متعددة لزيادة ثرواتهم بطريقة فعالة ومبتكرة.

مراجعة سريعة على العملات الرقمية

العملات الرقمية، أو العملات المشفرة، هي نوع من الأموال الرقمية التي تستخدم التشفير لتأمين المعاملات والتحكم في إنشاء وحدات جديدة. هذه العملات هي أصول رقمية تعمل كوسيلة للتبادل، وتستخدم تكنولوجيا البلوك تشين لتوفير نظام دفتر الأستاذ الموزع الذي يسجل جميع المعاملات بشكل آمن وشفاف.

الأنواع الرئيسية للعملات الرقمية

- بيتكوين (Bitcoin): أول وأشهر العملات الرقمية، تم إطلاقها في عام 2009. تعتبر بيتكوين كذهب العملات الرقمية نظراً لقيمتها واعتمادها الواسع.

- إيثريوم (Ethereum): تأسست في عام 2015، وتختلف عن بيتكوين بأنها توفر منصة لتشغيل العقود الذكية وتطبيقات اللامركزية، مما يوفر استخدامات أكثر تعقيداً من مجرد العملة.

- ريبل (Ripple): تركز على توفير حلول للمدفوعات العابرة للحدود للمؤسسات المالية، وتقدم تسويات مالية سريعة وفعالة.

- لايتكوين (Litecoin): شبيهة بالبيتكوين ولكنها تقدم أوقات معالجة أسرع للمعاملات وتكاليف أقل.

- كاردانو (Cardano): تعتمد على بحث علمي وتقدم ميزات مثل العقود الذكية والتداول اللامركزي.

مزايا العملات الرقمية

- الأمان: يصعب اختراق العملات المشفرة بسبب استخدام تكنولوجيا البلوك تشين.

- اللامركزية: لا تتحكم أي سلطة مركزية في العملات المشفرة، مما يقلل من خطر التلاعب أو التحكم من قبل أية جهة حكومية أو خاصة.

- الشفافية: جميع المعاملات متاحة للعامة ويمكن تتبعها، مما يزيد من الشفافية ويقلل من فرص الاحتيال.

التحديات والمخاطر

- تقلب الأسعار: العملات المشفرة تعاني من تقلبات شديدة في الأسعار، مما قد يؤدي إلى خسائر كبيرة.

- القبول: بالرغم من ازدياد القبول العام للعملات المشفرة، لا تزال العديد من الأماكن لا تقبلها كوسيلة للدفع.

- الأمور التنظيمية: العملات المشفرة تواجه تحديات تنظيمية في العديد من الدول التي قد تؤثر على استخدامها أو توسعها.

في الختام، العملات الرقمية تقدم فرصاً واسعة للابتكار والاستثمار، ولكنها تأتي مع مخاطر وتحديات يجب أن يكون المستثمرون على وعي بها.